Markets didn’t walk into Monday—they exhaled. After a weekend of sirens, fireballs, and backchannel diplomacy, the risk complex tiptoed back into the light, clutching at the thinnest thread of truce hopes. Traders, ever the eternal optimists when the tape allows it, ripped off Friday’s fear premium and replaced it with a shrug and a bid. Whether the relief rally has legs or just borrowed time is up for debate, but for now, global equities are once again dancing near their highs, as if the world isn’t toying with World War III headlines every six hours.

We’ve seen this act before: missiles fly, gold spikes, oil gaps higher, then somebody whispers "de-escalation," and the herd hits the 'buy” button.

Brent popped over 7% at the Asia open on Sunday, flirting with last week’s panic highs, before drifting back to earth as Iranian peace pipe overtures filtered in through Gulf intermediaries. Gold briefly reclaimed $3,450, a whisker from record territory, before giving up the ghost. And the dollar? Barely twitched—still limping in a post-peak exceptionalism daze.

The greenback’s performance was particularly telling. Faced with a genuine geopolitical curveball—Israeli jets hammering Iranian nuclear sites, Tehran launching symbolic retaliation, and the Strait of Hormuz risk climbing the wall of worry—you’d expect dollar bulls to roar back to life. Instead, the DXY managed a pitiful quarter-point pop, then faded. Compare that to the dollar’s muscular 2% spikes during prior Middle East conflagrations, and the takeaway is stark: America’s safe-haven aura is looking increasingly dented. Call it the cost of fiscal brinkmanship, or the Trump tariff re-run shaking foreign capital’s confidence. Either way, the buck no longer rallies just because the world is on fire.

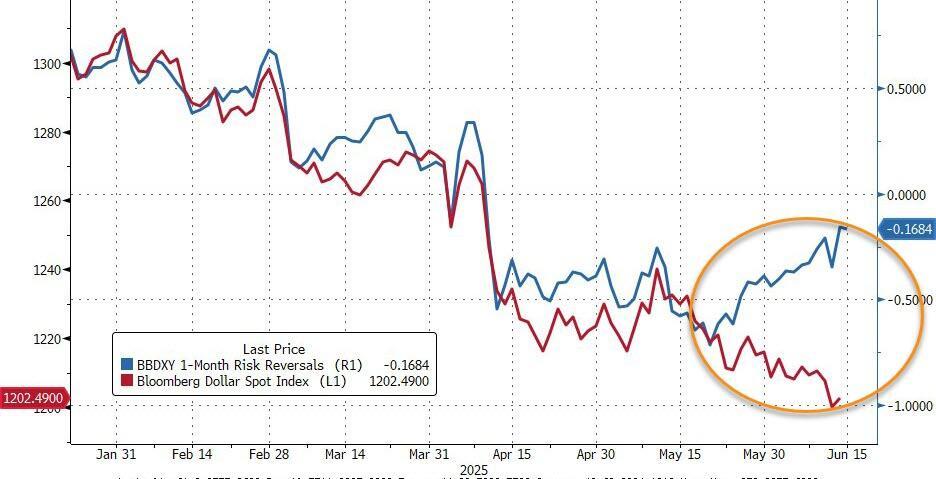

That said, the EURUSD’s failure to break through 1.1600 with conviction reinforces what we outlined over the weekend: the FX options crowd is backing off the maximalist anti-dollar narrative. The bleeding edge of bearish dollar positioning has dulled—implied vols are compressing, and skew is no longer leaning one-way traffic. There’s a growing sense that, geopolitics aside, we may have carved out a tactical trough in the dollar. Not a trend reversal, but a reprieve. A consolidation floor born not from strength, but from relative dysfunction fatigue.

It’s that classic FX moment where despair meets hedged caution—nobody’s ready to buy dollars hand over fist, but the appetite to aggressively fade it is thinning. The euro failed its moment of glory, and that tells us more than any press release from Vienna or Riyadh could.

Meanwhile, equities seem more than willing to look past the smoke. Nasdaq led the charge, while the Dow lagged—but all majors posted gains. Indeed, the Nasdaq played pied piper, leading the charge as shorts got torched and mega-cap tech soared. The Dow tagged along like a reluctant toddler, but the tape was green across the board. Cyclicals slapped defensives, and once again, the S&P 493 got dragged behind the Magnificent 7, leaving the rest of the market to huff dust while Apple and friends did the heavy lifting.

The rationale? Oil's impact on growth and earnings isn’t what it used to be. As long as Brent doesn’t moonshot the Street figures we’ll muddle through . That said, worst-case modelling—oil at $130, U.S. CPI tagging 6%—isn’t exactly a tail-risk traders can ignore, especially with central banks already dancing on a knife edge between credibility and capitulation.

In rates, the long end of the Treasury curve sold off, lifting yields even as VIX relaxed. But it’s the vol curve—more than the spot VIX—that tells the story. There’s tension coiled into the next 72 hours: retail sales on Tuesday, the Fed on Wednesday, and a big Option Expiration on Friday, all bracketed by a Juneteenth closure. Expect some positioning fireworks and thin liquidity to feed each other in a doom loop of intraday spikes.

Which brings us to the week ahead: a central bank conga line stretching from Tokyo to Washington. The Bank of Japan kicks things off, likely holding fire due to tariff-induced macro uncertainty. Then it’s Indonesia, Brazil, Switzerland, Sweden, Norway, the Bank of England, and—of course—the Fed. Powell & Co. are now playing whack-a-mole between soft data (cue: Empire Fed’s nosedive), spiking volatility, and the looming ghost of inflation reigniting if oil takes another leg higher.

Against this backdrop, U.S. domestic politics are throwing jet fuel on market mispricing. Trump, ever the disruptor-in-chief, has blocked a G7 de-escalation statement, leaning instead into pressure tactics on Iran, while publicly trashing the bloc’s old-school unity shtick. The result: a global leadership vacuum that forces traders to price in chaos as the new constant. At this point, the G7 is less a choir of democracies than a jazz ensemble improvising in different keys, with Trump belting out solo verses on tariffs and realpolitik.

So where does that leave us? Somewhere between a false dawn and the eye of the storm. There’s plenty of smoke, but the market’s playing with matches again—pricing in what hasn’t happened and fading what just did. Maybe equities are right. Maybe the missiles stop flying, oil drifts lower, and rate cuts resume their inevitable glide path. Or maybe the market’s standing on a trapdoor, mistaking fragility for resilience.

Either way, traders know the drill: when the fuse is lit, only the fuse knows the burn rate.

The View

The Middle East is once again the fulcrum of global market anxiety—but this time, the fuse isn’t just lit; it’s smoldering in real time while traders nervously bet on whether it fizzles or detonates. Iran’s backchannel white flags via Arab intermediaries look like classic diplomatic rope-a-dope: Tehran’s messaging that it’s open to talks if the U.S. stays on the sidelines reeks less of peace overture and more of a geopolitical timeout request. They’re not tapping out—they’re just asking for a breather before the next round.

Israel, meanwhile, isn’t exactly in a conciliatory mood. With its jets cutting clean paths over Iranian skies and Revolutionary Guard command centers turning to dust, Netanyahu is doing more than flexing—he’s going for a knockout. The goal may not officially be regime change, but if the theocracy collapses along the way, it’ll be chalked up as “collateral outcome.” And if the Israelis are indeed sitting on a two-week playbook of pre-planned strikes, markets better strap in.

Yet here’s the real risk that oil traders can’t ignore: this isn’t just tit-for-tat anymore. We’ve now entered energy infrastructure territory—Israel hit South Pars, and Iran struck the Haifa refinery. That’s no longer symbolic warfare. That’s a direct hit on the arteries of global crude and LNG flows. The Strait of Hormuz may still be open, but every missile volley now drags it closer to the edge of being blockaded or militarized. If that happens, forget $90 oil—we’re talking $130 fast-track chaos pricing.

From a market lens, Tehran’s messaging is a calculated bluff—“We’re open to diplomacy, but only if Washington holsters the bunker busters.” Everyone knows Fordow and Natanz can’t be cracked open without U.S. hardware like GBU-57s dropped from stealth bombers. Iran is betting the U.S. won’t escalate, but it’s also warning that if there's no off-ramp, the nuclear program accelerates and the war widens. That’s not de-escalation—that’s nuclear brinkmanship dressed in diplomat-speak.

So what’s the play here for traders? This conflict is now embedded with asymmetric headlines. Every lull invites risk-on relief rallies. Every explosion resets the volatility meter. Oil markets are operating in a rolling options market of worst-case scenarios—some of which are beginning to show their teeth. Energy risk isn’t being priced as tail anymore—it’s creeping into the base case.

And while Gulf states like Saudi and Oman are pleading with Washington to rein in the firestorm, their motives are obvious. They don’t want their LNG plants and oil terminals to become the next pawns in this regional chess match. If even one rogue missile clips a refinery in Dhahran or Ras Laffan, it won’t just be a Gulf problem—it’ll be a full-blown global energy crisis.

The equity markets may be pretending that cooler heads will prevail, but FX and commodities traders know better: the Middle East just became the world’s geopolitical margin call. One that no one wants to get exercised.