Nvidia's exceptional financial report revealed a remarkable surge in fourth-quarter sales, with revenues more than tripling compared to the same period last year and earnings increasing by more than eightfold. As a leading indicator in the artificial intelligence sector, Nvidia's performance underscores the growing significance of AI and other advanced computing technologies across the U.S. and global economies. The rapid increase in top-line revenue suggests a continued expansion of AI adoption, offering the potential for sustained productivity enhancements. These advancements could help offset rising wage costs, although it is important to note that we are still in the early stages of realizing this potential scenario.

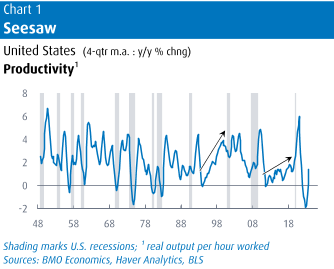

Aggregate productivity exhibits a cyclical pattern, as depicted in Chart 1. Productivity typically experiences a surge following recessions as spare production capacity is swiftly utilized. However, as capacity constraints tighten and employers increasingly tap into the available pool of workers, productivity growth decelerates, and in some instances, it may even contract. This trend suggests that as businesses operate closer to full capacity, the quality of available workers may decline, contributing to the slowdown in productivity growth.

The seesaw pattern in productivity often persists throughout the entire economic expansion phase, with the downward phase sometimes unfolding more gradually than the upward phase and oscillating intermittently. However, among the dozen post-WWII recessions, there have been two instances where, following the seesaw pattern, productivity growth resumed an upward trend until the onset of the next recession.

The first episode, spanning from the mid-1990s to the early 2000s, was defined by the widespread adoption of information technology (IT) in businesses. This adoption was facilitated by computer and semiconductor manufacturing advancements, leading to more efficient and affordable technologies, along with the widespread availability of the Internet. However, exuberance among investors led to the formation of tech and 'dot-com' bubbles, which eventually burst, causing significant market turmoil.

During the second episode, which spanned several years leading up to the pandemic's onset, the productivity growth was not as robust. While investments in information technology (IT), digitalization, and automation were already prevalent themes during this period, they gained additional momentum due to emerging labour shortages and corporate tax cuts. Consequently, there was widespread adoption of robotics in manufacturing, self-checkout registers at retailers, and ordering kiosks at restaurants, all aimed at enhancing operational efficiency and productivity.

In the current scenario, reminiscent of the AI-themed case, parallels can be drawn with the antecedents of the second episode. Labour markets remain tight, with shortages persisting. Moreover, the pandemic provided a significant impetus for businesses to adopt technology, further accelerating the trend. With the emergence of new technologies like artificial intelligence (AI), businesses have another tool to enhance productivity and efficiency. This scenario bears a soft resemblance to the dynamics observed during the first episode. The outcome of this trend remains to be seen, and it will be interesting to observe how it unfolds in the coming years.

Chair Powell and the Federal Reserve are indeed closely observing the dynamics of the pre-pandemic years as a reference point for guiding monetary policy. The period before the pandemic was characterized by strong and tight labour markets, accompanied by real wage gains that were economically and socially beneficial. Importantly, inflation remained contained during this time. The mild uptrend in productivity growth observed during that era played a crucial role in achieving this favourable economic environment. It's worth noting the parallels between the term "nirvana" and "Nvidia," albeit coincidental, perhaps reflecting the aspiration for an optimal economic state.

Research for this report was gleaned from BMO.