MARKETS

U.S. stocks are closing out their strongest week in a year, with modest movement on Friday capping off major gains and record highs earlier in the week. The big rally was sparked by Donald Trump’s election victory and a well-timed Federal Reserve rate cut aimed at bolstering the U.S. job market. The volatility index (VIX) has also dipped to around 15, reflecting a calmer sentiment following the decisive election outcome—a welcome relief for systematic flows.

Fox’s early election call hit the trading floor like a thunderclap, flipping the usual drawn-out election drama into a lightning-fast outcome. This swift result set off one of the largest two-day crashes in the VIX over the past decade. Funds that had cautiously pulled back to dodge election jitters suddenly found themselves in a mad scramble, piling back into the rally after betting markets had all but called a Trump victory weeks prior. Speculators, already well-positioned, watched as those with stricter risk controls rushed to catch up, having missed the Prediction market driven build up. The frenzy pushed Wednesday’s daily inflow into U.S. equities to its highest level in five months, underscoring the FOMO-fueled momentum sweeping the markets.

While U.S. stocks are reveling in a post-election rally, European equities are struggling to keep pace. Across the pond, traders are laser-focused on Trump’s potential tariffs, bracing for fresh headwinds that could hit European growth hard. Shorting the EUR/USD will quickly become the hot trade, with traders eager to jump in before the trade becomes too crowded. But with Trump, nothing is ever straightforward. Will these tariffs land with the force expected, or are they merely pawns in a larger game of foreign policy chess?

And what about the tax cuts? Do they bring a massive fiscal boost, or are they simply a repackaging of existing policies? And let’s not forget bond yields—could these cuts push them up, squeezing households and businesses alike?

In a world where Trump’s next move is anyone’s guess, assumptions are shaky at best. What’s certain is that the market loves a rally, and for now, it’s happy to ride the wave.

The big questions hanging over the market might not get answered anytime soon. But here’s the silver lining for risk-hungry investors: the Fed’s got a laser focus on the job market, which it’s gently hinting is on shaky ground. That December rate cut is practically gift-wrapped and ready to go, promising an extra boost for equities as we head into the holidays.

Then there’s Trump, a man who measures his success in points on the Dow. The last thing he wants is to rock the stock market boat, so expect him to throw a few pro-growth bones to Wall Street rather than unleashing any surprises that could spook investors. He’s playing to his audience, and they’re eating it up.

While the big questions around trade, tariffs, and tax cuts still loom large, the short-term picture is looking bright. Right now, the Fed is fully supportive, Trump’s unlikely to rock the market boat, and optimism is riding high.

When it comes to trading the “Trump Trade” through FX, I say lean into it! Our pre-election call—driven by those uncanny prediction markets—to short the EUR/USD still holds strong. We’re eyeing a target of 1.05 by year’s end, and if Trump swings that tariff hammer in 2025, you might just want to snag your “parity party” ticket! For now, though, stay nimble and keep an eye on those key levels.

TRUMP’s TRIUMPHANT RETURN

Hold onto your hats, folks—2025 could be one wild ride for the U.S. economy. With Trump heading back to the Oval Office and Republicans potentially holding the reins in Congress, the landscape is primed for sweeping policy shifts. Think new tax cuts, hefty tariffs, and tighter immigration policies that could shake up inflation, interest rates, the dollar, trade flows, and just about everything in between. The Federal Reserve might still have a hand in the economic controls, but Washington will be calling the shots.

Let’s start with the short-term boost to growth: consumer spending and business confidence are likely to get a lift from the Trump effect. We’ve modestly upped our U.S. GDP and spending forecast for 2025, partly because Trump’s win has given consumers and businesses a shot of confidence. A permanent extension of the Tax Cuts and Jobs Act is almost a given, and we’ve baked that assumption into out rates playbook.

Another bright spot? Productivity. Recent data revisions show stronger-than-expected productivity gains since 2019, and with the help of AI and increased capital spending, it’s conceivable that the U.S. might maintain this momentum. It’s a tailwind for growth that we’re cautiously optimistic about.

On the fiscal side, Trump’s proposed tax cuts could further fuel growth by putting more money in consumers’ pockets and slashing corporate tax rates. But there’s a catch—those cuts will likely stoke the federal deficit, potentially pushing inflation and long-term rates higher. The Fed, keen as it is on its rate-cutting mission, might be forced to hit the brakes if inflation rears its ugly head too aggressively. But that's a worry for 2026; for now, the Fed is all about fostering job growth.

Now, on to the tariffs—Trump has a bold plan to slap massive duties on China, Mexico, and other key trading partners. A 60% tariff on China, up to 100% on Mexico, and a baseline 10% on just about everything else could jolt import prices and give domestic producers room to hike prices. Translation: higher inflation, higher rates, and a stronger dollar. This is uncharted territory for the supply chain, as production will re-orient around Asia. Its difficutl to qunatify the endgame of these cost just yet, but the risk to growth and inflation is significant.

Immigration policies are the last wild card. Trump’s proposals for mass deportations, if they materialize, could chip away at GDP growth and labor supply while nudging up wages and prices. Im unsure if this has been factored into any actionable market playbooks because of the many unknowns, but make no mistake—it’s an elephant in the room that could reshape the labor market.

Bottom line? The markets 2025 outlook looks brighter, but it’s on shaky ground. Big policy shifts are looming, and they could swing our forecasts for GDP, inflation, and interest rates in unexpected directions. So, while the numbers look good on paper today, the real story will unfold as Trump 2.0 rolls out—and it may be anything but business as usual.

RED SWEEP

A possible Trump Trade extension?

The U.S. election results are shifting the economic landscape—and it could be a seismic shift if the Republicans lock down the House. A potential red sweep across all three branches of government suggests a near-term boost for growth, stocks, and the dollar. But there’s a catch: it could also light a fire under inflation, push interest rates higher, and throw trade policies into an uncertain frenzy.

As of now, House Republicans are leading 211-199, with 25 seats still up for grabs, mostly in California and other Western states where counting can drag on. If the GOP does clinch it, we’re looking at a likely green light for Trump’s economic game plan—think hefty tax cuts, tariffs galore, and big-ticket spending. First on deck would be extending the Tax Cuts and Jobs Act beyond 2025, a move the Committee for a Responsible Federal Budget estimates would add $5.35 trillion to the deficit over a decade. Throw in Trump’s other tax proposals, like nixing taxes on overtime, repealing the SALT cap, and slashing corporate tax rates to 15%, and we’re talking a possible $10 trillion budget gap over the next ten years.

To cushion this, Trump’s floated a universal 10% tariff on all imports and a whopping 60% on goods from China, which could drum up an estimated $2.7 trillion. Even so, according to BMO Economics, the public debt could skyrocket to 142% of GDP by 2035 under these plans, compared to 125% under current law.

In the short run, the U.S. economy could see a boost from this fiscal stimulus and deregulation frenzy. But higher tariffs, retaliatory trade policies, and the prospect of rising inflation could undermine those gains. The Fed would likely face tough choices—potentially holding interest rates higher for longer or even hiking them again to prevent the economy from overheating. And let’s not forget, the big guns like corporate tax cuts may not fully impact the economy until 2026.

So, while the Republicans rally, we could be in for a thrill ride that’s as risky as it is rewarding, with the Fed on standby and Trump’s tariffs looming like a double-edged sword. Buckle up—it’s going to be quite the economic spectacle.

Trump's Victory Puts China in the Hot Seat: Beijing Braces for Impact

With the U.S. election in the rearview, China’s policymakers are breaking out the calculators and caffeine. The Trump administration’s return could spell trouble, especially if the President-elect decides to play hardball and unleash tariffs of up to 60%-100% on Chinese imports. Such a move would hit China right where it hurts—its export-driven economy that’s already reeling from a sluggish housing market and mounting debt.

While it’s tempting to play a game of “How Bad Could It Be?” with a tariff hike, the truth is, the potential damage is a bit of a wild card, none more so than will Trump actually follow through.

According to most economists , a 60% tariff could theoretically drop China’s GDP growth from a decent 4.5% to a nail-biting 2.0% in 2025, but this comes with a lot of “what ifs.” The real impact would depend on how both domestic and multinational firms respond—will they pack up and move manufacturing elsewhere? Beijing’s reaction will be pivotal too, whether they retaliate with tariffs of their own or pull out the fiscal toolkit for some stimulus fireworks.

But here’s the kicker: when China recently revealed its anticipated 10-trillion-yuan stimulus, the market felt more of a fizzle than a bang. Hopes were high for a fiscal cannonball, but instead, Beijing focused on debt relief for local governments—great for stabilizing infrastructure projects, but not exactly the growth rocket some had hoped for. Yes, it’s a big number (around 8% of GDP), but it’s aimed more at smoothing over debt issues for local government financing vehicles than directly juicing economic growth. Word on the street is that the Ministry of Finance may have a few more tricks up its sleeve, possibly including infrastructure spending and housing support.

Then there’s the PBoC, which is stuck between a rock and a hard place. They could let the yuan slide to make exports more competitive against U.S. tariffs, but a full-on devaluation carries serious risks, like capital flight and financial instability. Imagine billions flowing out of China, shrinking bank deposits, and stifling credit—it’s a worst-case scenario the central bank wants to avoid at all costs.

CHART OF THE WEEK

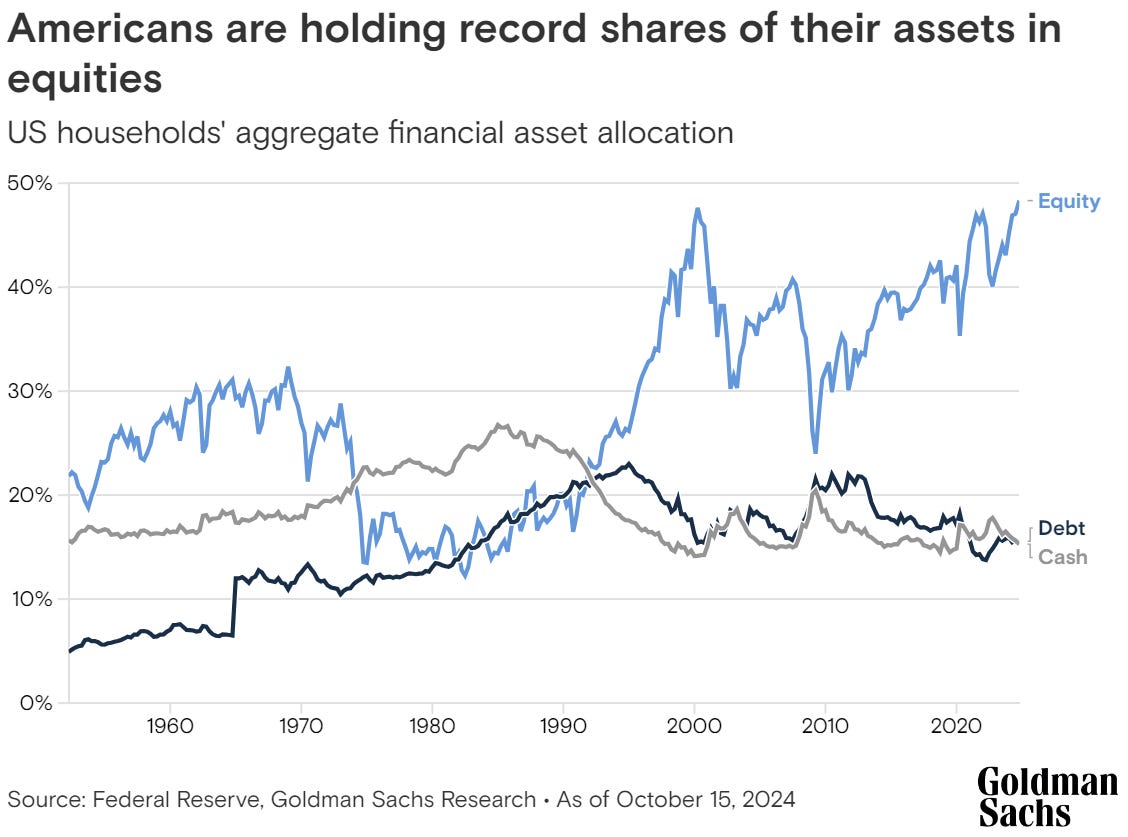

As the Federal Reserve trims rates, you might expect a flood of cash flowing out of money market mutual funds and into stocks, sparking an equity rally. But according to Goldman Sachs Research, it’s not so simple. Money market funds tend to keep attracting inflows even during rate cuts, while the real flow into equities depends on broader economic vibes.

U.S. households have been making bold bets on the stock market, with equities now making up a hefty 48% of their financial assets—matching an all-time high last seen around the turn of the century. Meanwhile, cash allocations are near rock-bottom levels, sitting around 15%, as per the Fed’s Financial Accounts data.

With equity allocations far above the long-term median of 28%, households seem to be feeling the market’s pull. “Historically, households flock to equities during times of robust economic growth,” notes David Kostin, Chief U.S. Equity Strategist at Goldman Sachs Research. And with U.S. GDP growth averaging 2.9% in 2023 and holding at 3.0% for the first half of 2024, the economy has toggled between recession jitters and growth optimism, making this a fascinating moment for market positioning.

RUNNING UPDATE

For the past 6 to 8 weeks, you've been reading the "grumpy runner" version of my journey—basically, a saga of struggles trying to find that elusive runner’s zone. But lately, I’ve thrown caution to the wind, ignored Dr. Garmin’s stern “rest” advice, and decided to just go for it, clocking daily uptempo( just below threshold) 7-8 km runs like I'm on some kind of mission. Positive splits are finally happening, and while I'm not quite back to my 2022 glory days, I’m seeing glimmers of progress. My VO2 max is inching upward, and my endurance score is one good run away from setting a year high, giving me just enough motivation to keep chasing that “runner’s high.”.

The runner’s zone—my own version of the promised land—is almost within reach.

RUNNING SONG OF THE WEEK

Rediscovering a band you once loved, especially after a long hiatus, is like unearthing a buried treasure—those forgotten gems hit with a whole new intensity. Take U-2’s One Tree Hill, for example—a song critics have described as "a soft, haunting benediction," "a remarkable musical centerpiece," and "a celebration of life." But to me, it’s so much more—a song of pastoral tenderness, hymn-like and beautiful, that taps into something deeply emotional.

Revisiting it took me right back, reminding me of the connection I had with this music years ago. It was like flipping a switch, and suddenly I was transported into that dreamy, almost meditative running zone. Sometimes, the best kind of nostalgia is the one that surprises you, bringing back a piece of yourself you didn’t realize had drifted away.