Reading The PCE Tea Leaves

I also do a spin on a GS concentration risk note and discuss algorithmic trading trends

MARKETS

Equity markets continued their upward trajectory last week, supported by robust growth data. The S&P 500 index posted a 0.4% gain, buoyed by strength in utilities, banks, and healthcare sectors. However, the technology and telecom services sectors, which have been high fliers, experienced some lag in performance during the week.

Economic data remained robust, with US real GDP growth for Q4 revised to 3.4%, following a substantial 4.9% growth rate in Q3. This consistent performance marks six consecutive quarters of solid growth, with the economy maintaining a pace of 2.1% or higher. The resilience in economic growth appears to mirror the steadfast and nearly uninterrupted rise in the equity market.

With robust economic growth and a sustained rally in equity markets, optimism among retail investors is reaching remarkable heights. However, such exuberance on Main Street often serves as a contrarian indicator. *

In the March survey by the Conference Board, the proportion of respondents anticipating higher stock prices over the next 12 months surged to its second-highest level on record, trailing only the peak seen in January 2018. Concurrently, pessimistic sentiment has waned significantly. Historically, elevated levels of optimism among retail investors have preceded market corrections. Similarly, the Investors’ Intelligence Survey indicates an exceptionally high ratio of bulls to bears among advisors, a signal historically heralded market downturns.

Furthermore, the sentiment indicators are flashing warning signs across various surveys. For instance, in the AAII survey, the ratio of bulls to bears is approaching levels not seen in over a decade. This surge in bullish sentiment is accompanied by a conspicuous absence of bearish sentiment, a trend that aligns with the prolonged period of market gains and low volatility. While this doesn't necessarily guarantee an imminent market correction, it does suggest that the market's upward trajectory may face headwinds, especially if unfavourable news emerges. Or even if an earlier-than-expected “Sell in May and Go Away” starts to take hold **

Reading The PCE Tea Leaves

With the bond markets and the S&P 500 closed on Friday, investors will have the first chance to react to the PCE data on Monday, leaving ample time to contemplate its significance. With the data in the rearview mirror and nothing in the numbers to alter current bullish perceptions, the market should open up on an even keel on Monday.

There wasn't much movement or new information post-PCE in FX markets, which remained active on Friday. This lack of significant activity is unsurprising, as traders are likely waiting for bonds and equities to open on Monday before making any decisive moves.

The latest data on PCE inflation for February reveals a moderation in price pressures, with a month-on-month increase of 0.3%, slightly below the whisper forecast of 0.4%. This comes after a revised upward increase of 0.4% in January. Despite this moderation, inflation remains elevated, presenting a challenge for the Federal Reserve in its decision-making regarding interest rates. The three-month annual rate on core inflation stands at 3.5%, up from 2.9% over the last six months. The supercore metric, which excludes energy and housing, is even higher at 4.5% over the last three months compared to 3.8% over the last six months. Year-on-year, headline inflation increased to 2.5%, consistent with previous expectations.

The rise in prices last month was primarily driven by increases in energy and goods by 2.3% and 0.5%, respectively, while services and food moderated to 0.3% and 0.1%. Core inflation, excluding food and energy, also slowed to 0.3% month-on-month from an upwardly revised 0.5% prior month. Year-on-year, core inflation declined to 2.8% from 2.9%, aligning with consensus forecasts before the release.

In February, personal spending grew by a stronger-than-expected 0.8% month-on-month, a significant improvement from the meagre 0.2% increase seen in January. This robust growth can be attributed to solid job growth and favourable weather conditions. Real personal spending also saw a healthy uptick of 0.4%, driven by a solid 0.6% increase in real services spending, particularly in areas such as international travel, financial services, and insurance. Real goods spending increased by 0.1%, led by purchases of motor vehicles and parts.

However, the vigorous spending activity led to an increase in households dipping into their savings to finance their purchases. The personal saving rate dropped from 4.1% to 3.6% as spending outpaced income gains.

Meanwhile, personal income growth saw a more modest increase of 0.3% in February, following a substantial 1.0% gain in January, which was influenced by one-time cost-of-living social security benefit increases. Although wages and salaries saw a notable 0.8% jump, disposable income growth slipped to 0.2% and fell by 0.1% in real terms last month. This slowdown from the previous quarter's growth in real disposable income is expected to impact consumers' spending behaviour in the coming months.

Is The S&P 500 To Concentrated?

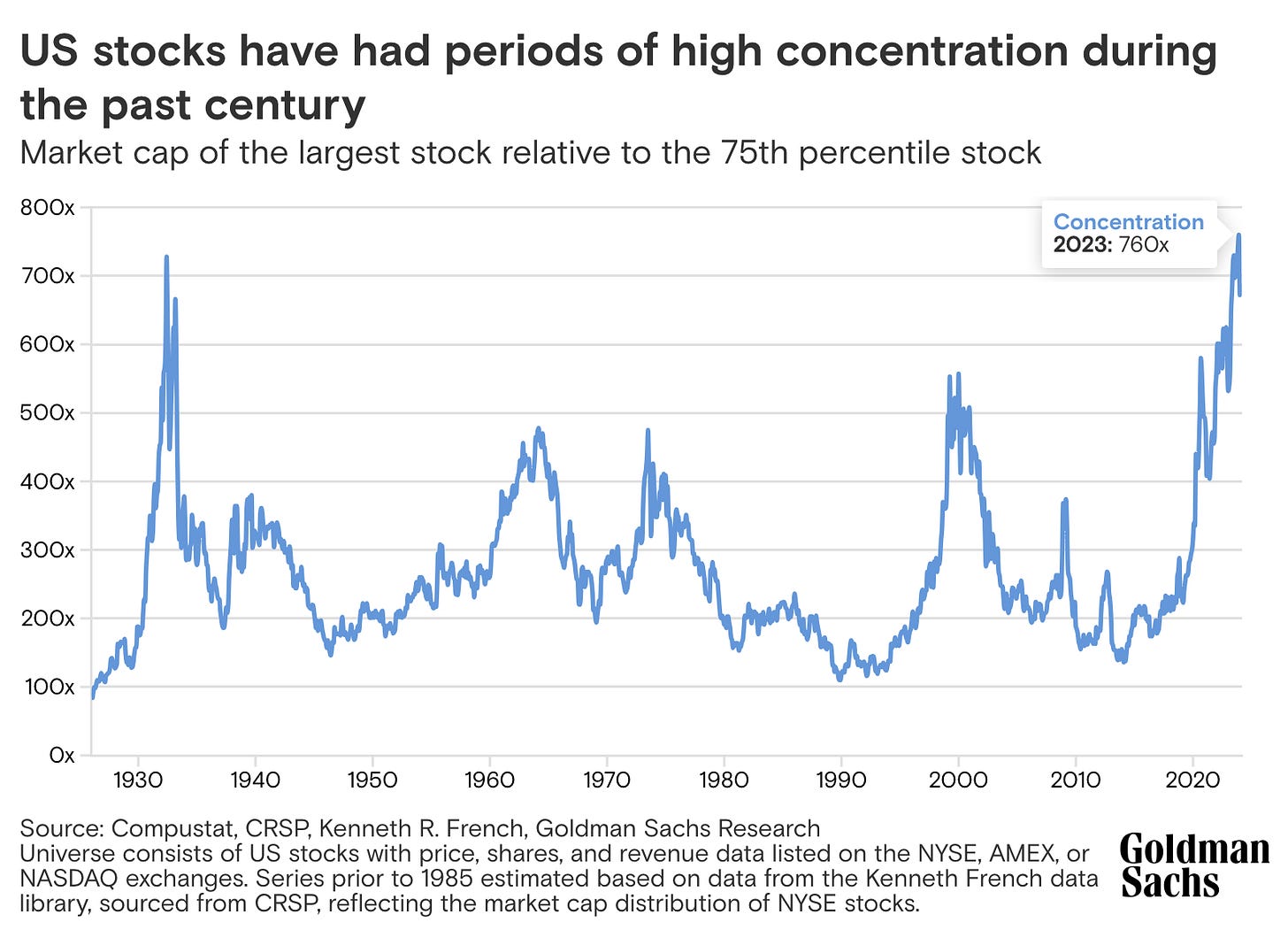

Despite concerns about the stock market being increasingly dominated by a small group of powerful companies, often called the "Magnificent Seven," Goldman Sachs Research analyzed S&P 500 market cap concentrations spanning the past century. The findings suggest that, in most cases, the market continued to rally despite this concentration.

This historical perspective offers reassurance to investors who may be worried about the potential impact of such concentration on market performance. While concentration may be a notable trend, it hasn't necessarily spelled doom for broader market gains. (Listen to the Goldman Sachs Exchanges episode on market concentration here.)

The concentration of the top 10 most extensive US stocks, which now represent 33% of the S&P 500 index's market value, surpasses the 27% share observed during the peak of the tech bubble in 2000. Ben Snider, a senior strategist on the US Portfolio Strategy macro team at Goldman Sachs Research, highlights this trend in the team's report.

Despite concerns about elevated concentration levels, this phenomenon coincided with a solid return period in the US market. For the past five years, the S&P 500 has delivered an annualized total return of 16%, outpacing the 30-year average of 10%. More than a third of this gain can be attributed to the top 10 stocks.

Snider emphasizes that while investors may typically view heightened concentration as a potential downside risk, historical data suggests otherwise. Following past instances of peak concentration, the S&P 500 often experienced rallies rather than declines. Furthermore, Snider points out that today's top stocks trade at lower valuations than the largest stocks during the tech bubble peak. Additionally, these leading companies boast higher profit margins than during previous periods of high concentration.

.Despite conventional wisdom associating elevated concentration with potential downside risk, the findings suggest a different narrative.

By integrating their bottom-up equity database with research on factor returns by University of Chicago professors Eugene Fama and Kenneth French, Goldman Sachs researchers identified seven instances of "extreme" concentration in which the top 10 largest stocks dominated the market.

During these episodes, which marked peak concentration, the S&P 500 surprisingly experienced more rallies than declines in the 12 months following. This unexpected resilience challenges the notion that heightened concentration invariably leads to market downturns, underscoring the complexity of market dynamics and investor sentiment.

In most of these periods of peak concentration, stocks continued to rally, challenging the conventional expectation of market downturns. Notably, recent instances in 2009 and 2020 coincided with significant improvements in the macroeconomic landscape. For instance, the 1932 peak concentration marked the nadir of a significant economic downturn, with the S&P 500 subsequently experiencing a robust uptrend.

Similarities emerge with episodes in 1973 and 2000, drawing parallels to present circumstances. Low unemployment rates and rising concentration levels accompany strong equity market performance. However, historical precedence suggests caution, as in both instances, the peak of market concentration coincided with the apex of bull markets, followed by economic recession in the subsequent year.

Nevertheless, the 1964 case offers a counterpoint. Despite a decline in market concentration that year, the bull market persisted, with share prices and the US economy remaining robust for an extended period. This example underscores the complexity of market dynamics and the varied outcomes associated with different concentration levels.

Are Stocks Overvalued?

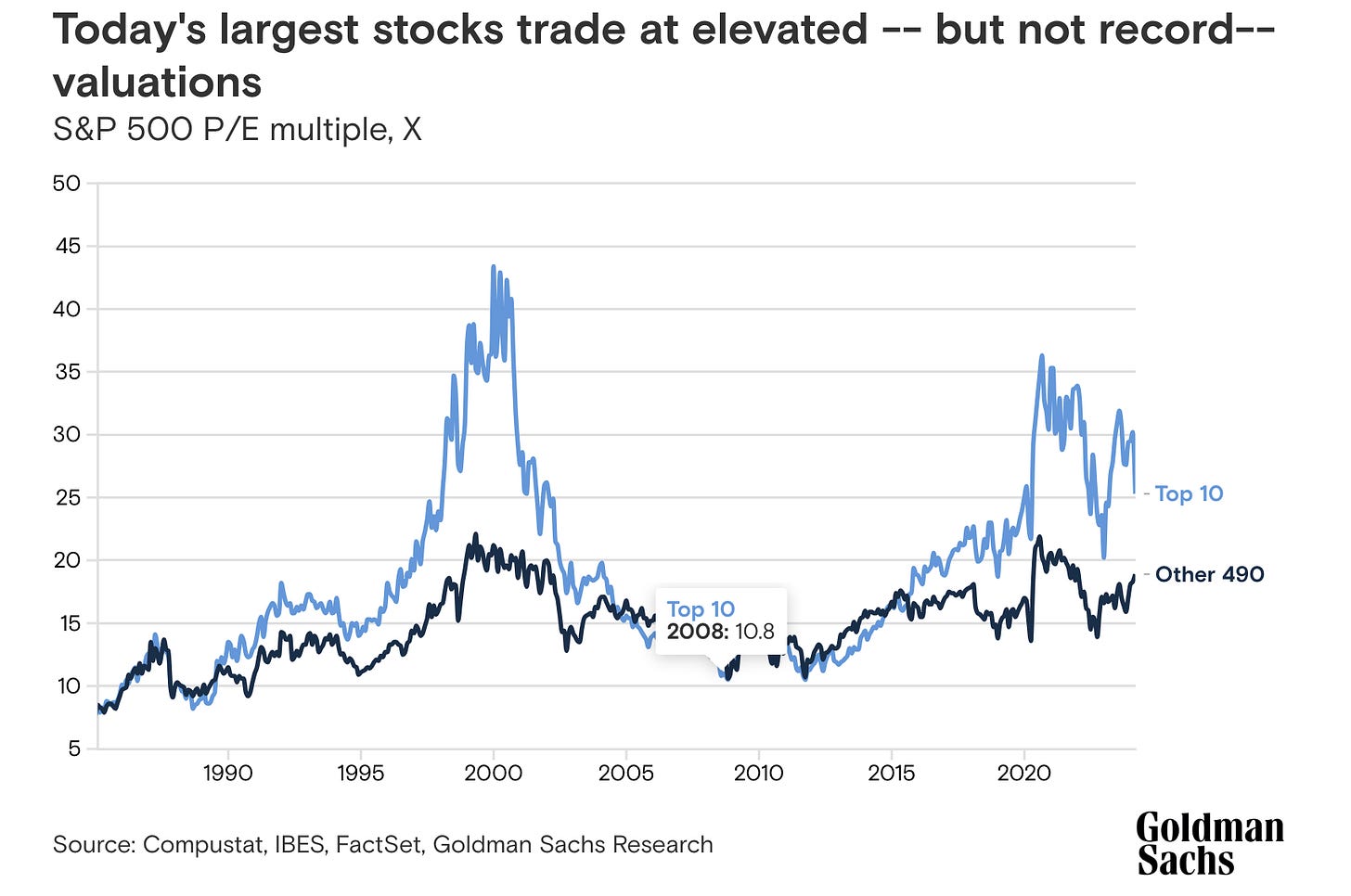

The report highlights that the valuations of the largest stocks remain notably lower than previous highs. The collective forward price-to-earnings (P/E) multiple of the top 10 stocks stands at 25x, significantly below the peak valuations observed in 2000, 2020, and the middle of 2023.

Moreover, valuations seem more subdued when considering the premium at which the largest stocks trade relative to the rest of the S&P 500 index. The current 35% valuation premium is considerably lower than the 80% premium seen in the middle of 2023 and the staggering 100% premium witnessed in 2000.

Indeed, although market cap concentration is currently higher than the peak in 2000, it's essential to note that the largest stocks are trading at much lower multiples than the tech bubble era. The valuations observed today are similar to those seen with the largest stocks in 1973. However, it's worth highlighting that the current market leaders generally boast higher profit margins and returns on equity than the top stocks in either 1973 or 2000, as outlined by Snider.

Momentum During High Periods Of Concentration

One notable trend observed across market concentration episodes is the influence of momentum. Momentum refers to the tendency of trending stocks to continue moving in the same direction. In each episode examined, researchers found that momentum surged as the large market leaders outperformed, increasing their weight relative to the rest of the market and consequently lifting market concentration. However, as market concentration peaked and subsequently declined, momentum also waned.

While the momentum factor has performed well in the current episode, gaining 12% year to date and 19% over the past 12 months, it falls short in magnitude and duration compared to past market concentration episodes. Historically, investors have succeeded in investing in momentum laggards, which are stocks with low momentum, even during market downturns. In fact, in 26 peak-to-trough momentum reversals since 1930, low momentum laggards have appreciated in absolute terms in every instance.

This phenomenon occurs because, during market sell-offs, investors tend to flee from stocks perceived as vulnerable and flock to perceived safe havens, thereby boosting momentum's long/short performance. Subsequently, when market conditions improve and the market rebounds, investors rotate out of these leaders and back to the laggards.

While current concerns revolve around the potential for a sharp drop in the largest stocks to lead to a market downturn, historical data suggests that 'catch-up' episodes are more common than 'catch-down' experiences.

CHARTS OF THE WEEK

This week i've written about how analyst optimism has turned down (defined as % of eps upgrades, 6m mav). What surprised me given all the hype about AI boosting profits is optimism topped out at only 50%. As an ex-girlfriend once said to me, "is that it?".

·

For the first time in 6 quarters, asset managers surveyed think global equities will outperform bonds over the next 12 months. via

The US gov't debt machine is truly out of control. The US (lhs) runs a budget deficit that's more than twice as big as Canada, Euro zone, Japan & UK combined (rhs). More important, the US - unlike everyone else - funds all this with very short-term debt (red). What are we doing?

FOOTNOTES

Reverse Engineering Models

There is a common misconception that you can do the opposite of retail traders and be successful. I’ve even seen this nonsense get amplified by so-called analysts for MT4 bucket shops (who mostly are content creators these days to attract clickbait). If it were that easy, we would all be rich, and every broker on the street would run a B book and make $170-200 per million USD traded. ( most make $ 75-90 per million USD traded still a tidy some mind you). For the record when I was running OANDA Singapore, our best B-Book Quarter was $140 per million traded. So if your broker turns 20 billion USD per day, you do the math. Hence, now you know why MT 4 retail shops pop up like 7-11’s do in Thailand; there is money in those hills. Without going into details, let’s say that retail traders’ entry trades have nothing to do with their AUM decay calculation, so do not fall for that do the opposite of what retail traders positions are nonsense. On the other hand, sentiment indicators are surprisingly accurate.

The big push for reverse engineering now sits around dealer Gamma positioning and, importantly, what CTAs( Commodity Trading Advisors) are doing.

Over the past decade, three major developments have significantly influenced global markets: the rise of algorithmic trend-following strategies, the prevalence of risk-parity portfolios, and the practice of dealer gamma hedging.

Algorithmic trend-following strategies have become increasingly prominent, with approximately 70% of transactions in futures markets now executed by machines. While high-frequency traders account for about half of these transactions, they have a minimal impact on directional flows. Instead, momentum-chasing Commodity Trading Advisors (CTAs) are the primary drivers of market movements, exacerbating price swings.

Risk-parity portfolios, which allocate capital based on risk rather than traditional asset class weightings, have also gained traction. This approach aims to balance risk across asset classes, but it can amplify market fluctuations as investors adjust their allocations in response to changing volatility levels.

Another significant development is dealer gamma hedging, which involves options dealers adjusting their positions to manage their exposure to changes in the underlying asset's price. This hedging activity can contribute to market volatility, especially during periods of heightened uncertainty.

CTA trend followers, in particular, play a crucial role in market dynamics. Market fundamentals drive their activity but often contribute to overshooting price action. For example, while tightening oil supply from Saudi Arabia and Russia initiated a run-up in oil prices, CTA trend followers extended the rally through their buying activity.

Understanding the positions held by CTAs can provide insights into market behaviour and help anticipate potential price movements. However, their influence highlights the complex interplay between fundamental factors and algorithmic trading strategies in today's markets.

Sell In May And Go Away

The "Sell in May and go away" adage is indeed a well-known seasonal trading strategy, based on the idea that stock market returns tend to be weaker during the summer months compared to the rest of the year. The strategy suggests selling equities in May and staying out of the market until the end of October to avoid potential losses during this period of supposed underperformance.

However, whether this strategy leads to good returns depends on various factors, including market conditions, individual investor goals, and risk tolerance. While historical data may show some correlation between weaker summer performance and the "Sell in May" period, it's important to note that past performance is not always indicative of future results.

Critics of this strategy argue that it's a simplistic approach based on market timing, which can be difficult to execute accurately and consistently. Market timing strategies rely on predicting short-term movements in stock prices, which can be highly unpredictable and subject to various external factors such as economic indicators, geopolitical events, and unexpected news developments.

MARATHON TRAINING UPDATE

I find myself about 4 weeks behind in my training plan for the upcoming Hua Hin marathon. This setback stems from a preventable injury unrelated to sports, and although I managed to complete a solid base building phase with 21 runs in March, I'm far from running at my desired pace, let alone achieving personal bests. However, it's reassuring to know that I'm not alone in facing such challenges.

In many cases, falling behind in training pace can actually be beneficial. It indicates that you're steadily accumulating mileage through easy runs hugging the zone 2 area When executed correctly, this approach ensures that you'll arrive at the start line fully prepared to run significantly faster than in any of your previous workouts, and maintain that pace for a significantly longer duration.

There is no secret sauce here, the primary reasons to run slowly on your easy days and for most of your long runs is that slower running builds the aerobic system.

And the reason having a great aerobic system is critical is because 85-99% of the energy needed to race any distance longer than 800 meters, comes from the aerobic system.

There is simply no better way to train the aerobic system than easy running.

SONG OF THE DAY

As selected from what track stood out and motivated me on my weekend long run.

One of my favorite hometown( Toronto) Early 80’s bands