Nvidia Corp. (NVDA): Communacopia + Technology Conference 2023 — Key Takeaways

Presenters: Manuvir Das, VP, Enterprise Computing

Bottom line: Mr. Das discussed 1) how Nvidia is working with partners to democratize AI across the Enterprise space; 2) its ability to address the inference market in addition to the training market through its common platform approach; 3) the DGX Cloud business, particularly the parallels that can be drawn with the Nvidia DGX; 4) the launch of the L40S and what it offers to customers; and 5) the current supply environment.

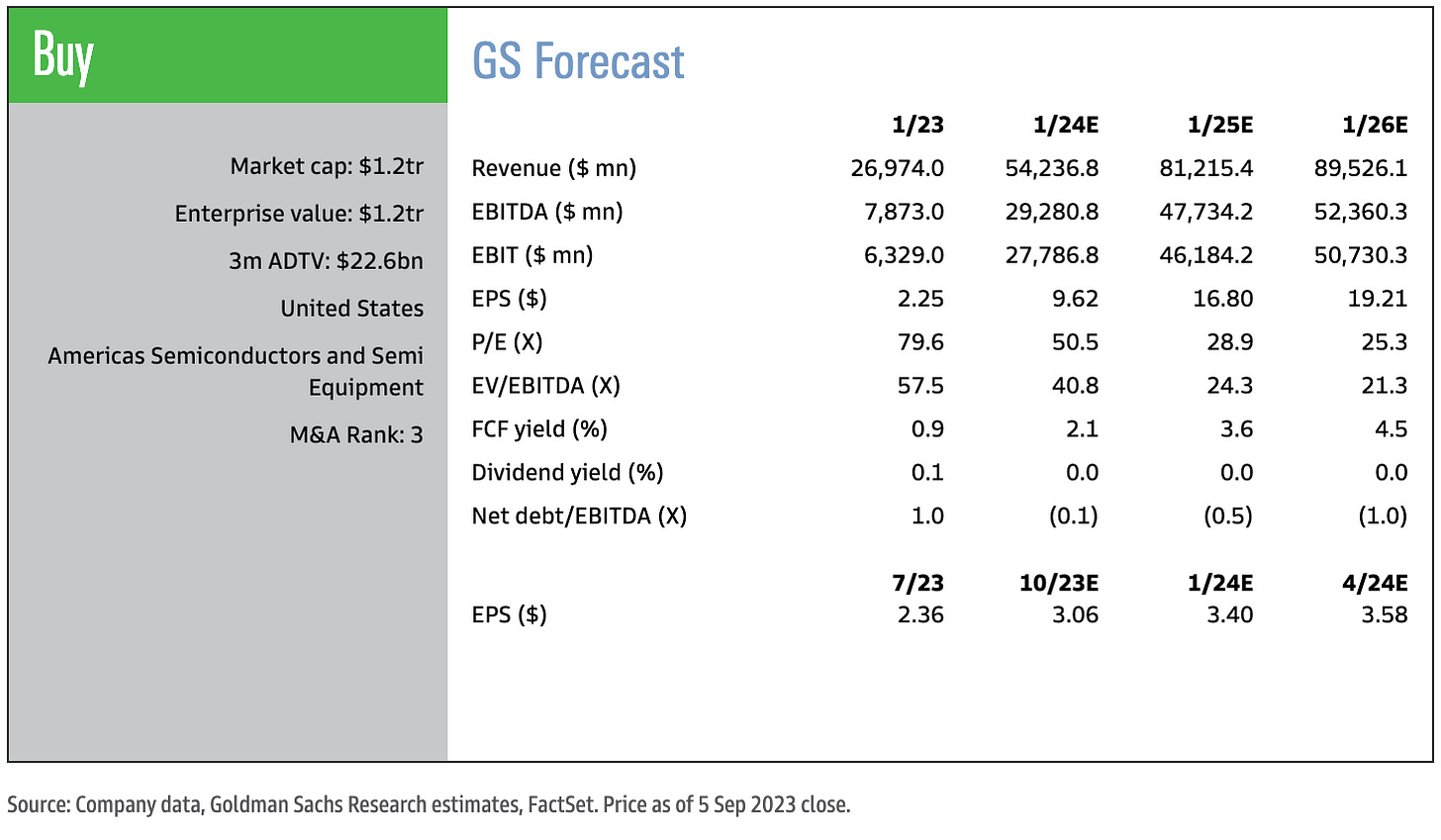

Goldman Sachs Outlook

NVDA12m Price Target: $605.00Price: $485.48Upside: 24.6%

Key Takeaways

1) Democratization of AI: Mr. Das discussed how Nvidia is helping democratize AI across the broader Enterprise market and highlighted partnerships with the likes of VMWare, Snowflake and ServiceNow. He noted that customer engagements are growing and that customers these days typically come to Nvidia with a specific AI problem in mind as opposed to Nvidia approaching the customer with a recommended solution (which was typically the case earlier on in the AI era).

2) Training vs. Inference: Mr. Das noted that their common platform approach augmented by its robust software stack will be effective in addressing the Inference market -- an area in which Nvidia is currently under-represented vis-a-vis its dominant position in Training.

3) DGX Cloud: Mr. Das highlighted that DGX Cloud is not in competition with its CSP customers, but rather it is a tool that can be used to showcase a 'state of the art' cloud offering. To reinforce his point, he drew parallels with their DGX systems which catalyzed an increase in the number of accelerated servers across its OEM customer/partner base.

4) L40S: On the L40S, a recently introduced data center GPU, management highlighted that it can be effective in addressing back-end workloads such as fine-tuning (i.e. form of training that is less compute-intensive than training a LLM from scratch) and inference, and that it will be complementary to the H100 - from a performance as well as physical supply perspective.

5) Supply constraints: although Mr. Das was understandably unwilling to predict as to when supply of GPUs was expected to catch up to demand, he noted that the company is working with its suppliers/partners to bring more capacity online and that the introduction of the L40S (which does not require CoWoS or a form of advanced packaging that is one of, if not, the major bottlenecks today) will also serve a role in meeting growing demand for GPUs in the data center.

Valuation/Risks

We are Buy-rated on Nvidia. Our 12 month price target of $605 is based on normalized earnings power of $11.00 and a target multiple of 55x. Key downside risks to our estimates and price target include: 1) cyclicality in data center spend by cloud hyperscalers and/or enterprises on a quarterly/annual basis; 2) loss of market share in Data Center GPUs; 3) worse-than-expected demand for Gaming GPUs; 4) further tightening of China export restrictions, 5) delays in new product introductions and their impact on revenue and profitability, and 6) supply chain issues.