Asian equities took a dive, tracking the volatility on Wall Street as a perfect storm of concerns hit sentiment hard. China’s shaky economic outlook and an increasingly tight U.S. presidential election race are clouding the horizon. Big tech, the backbone of many global portfolios, wasn’t spared in the carnage—Nasdaq 100 dropped nearly 2%, leaving investors with a stomach-churning gut punch. Apple felt the heat, but the real disruptor was U.S. Treasury yields surging to uncomfortable heights, leaving markets jittery.

The problem? Yields are rising for all the wrong reasons. Typically, stocks can stomach rising yields if they’re fueled by economic expansion. But this latest surge falls squarely into the "too fast, too soon" category, especially against the backdrop of sky-high valuations. And here’s the kicker: it’s happening for the very reasons that stock markets despise. The bond market is flashing red, increasingly factoring in the risk of a "Red Sweep"—a Trump victory with a Congress poised to rubber-stamp his inflation-boosting agenda. Picture this: higher tariffs, looser fiscal policy, and tighter immigration controls, all of which could set the stage for runaway inflation and wage pressures. It’s precisely the scenario that keeps equity investors up at night.

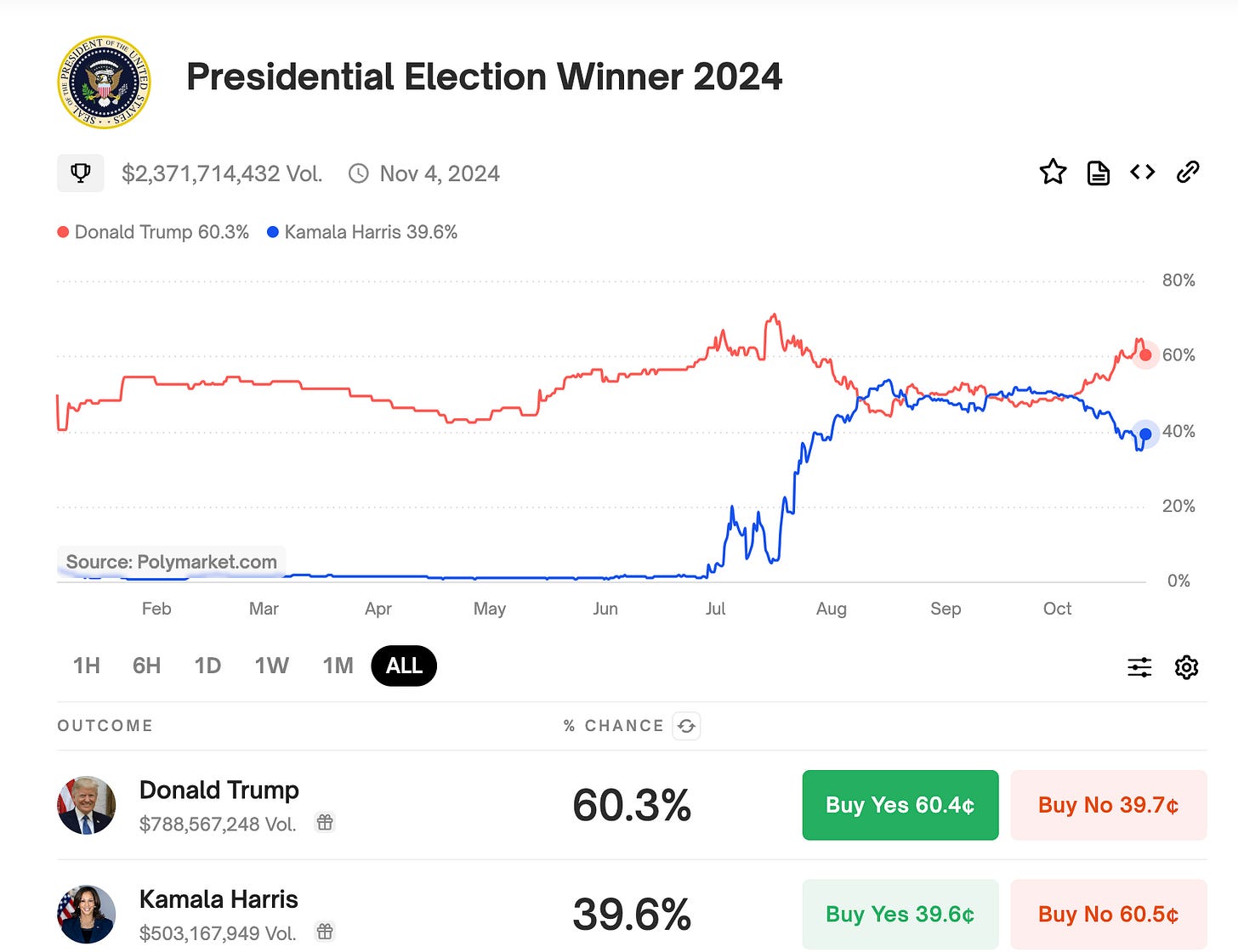

Even though we’ve seen some paring of dollar longs as betting markets tighten on platforms like Polymarket, with odds narrowing by 4-5 points and implying a potential 25-35 pip move lower in USD/JPY, I still believe that selling the dollar ahead of the U.S. election is going to be an uphill battle.

Trump continues to gain momentum in the polls. The latest WSJ poll shows Trump inching ahead, while sentiment surrounding Vice President Harris has taken a nosedive. What’s even more concerning for the Democrats is that unfavourable views of Harris now outnumber favourable ones by a significant eight-point margin, 53% to 45%.

With Trump gaining steam, the dollar’s short-side trade faces stiff resistance, making it increasingly challenging for dollar bears to hold their ground as election day draws near.

But hold your horses—liquidity is thinning, and volatility will likely spike from here. Risk managers are tapping traders on the shoulder, warning that the next swings could be brutal. Yes, a lack of liquidity can enhance your position, but it can also expose you to wild sentiment shifts—so trade carefully.

Back to our bread-and-butter trade.

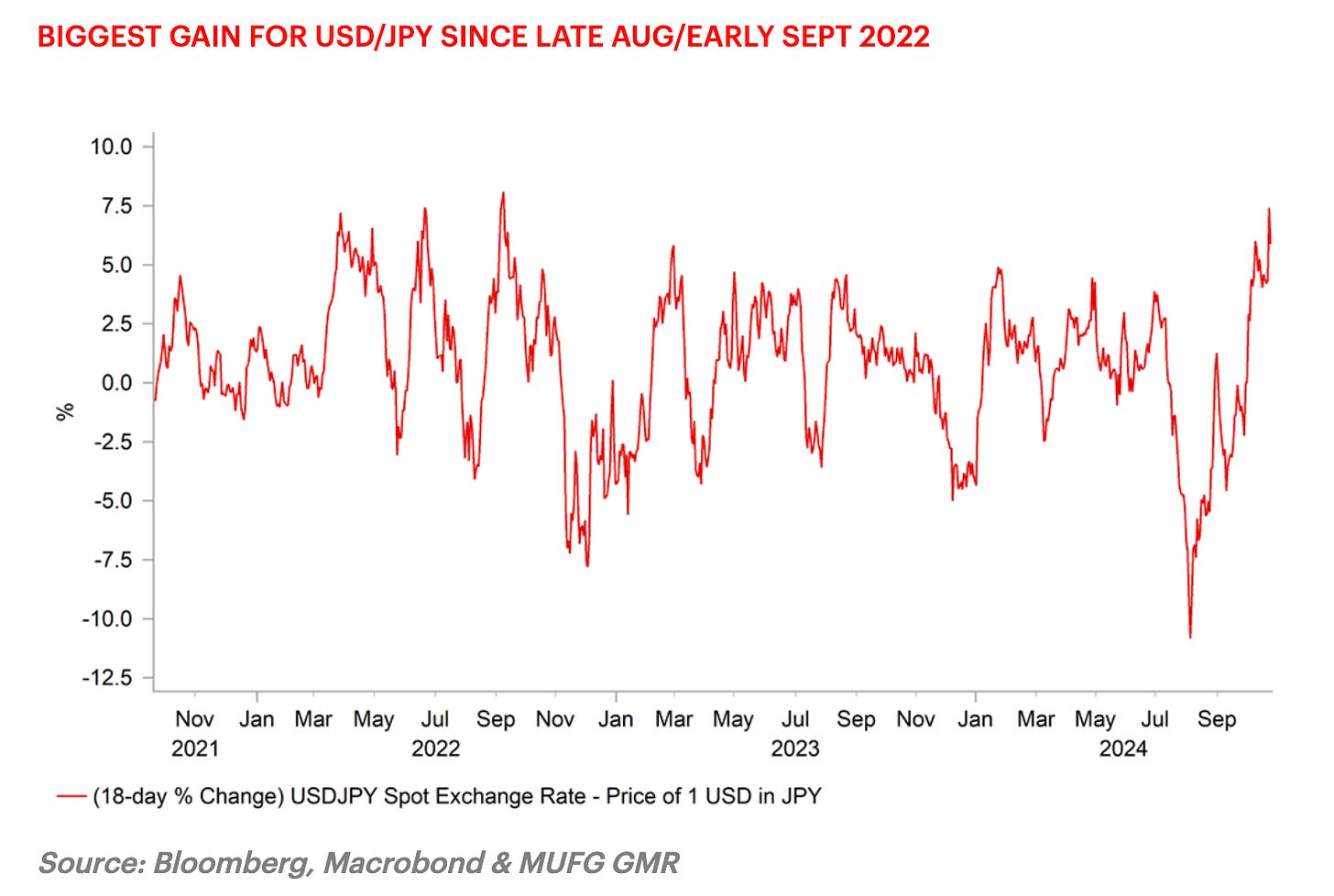

The yen’s showing a bit of a comeback after yesterday’s bruising sell-off, with USD/JPY pulling back to around 152.00 after peaking at an intraday high of 153.19. But let’s not get too carried away with this modest rebound. The yen has already lost over 6% this month, making it the weakest stretch since late August/early September 2022—before Japan swooped in with an intervention.

Now, the whispers of another intervention are getting louder, with many wondering if Japan will step in again. But let’s be real: Japan might hold off with the U.S. election looming and Trump’s odds looking up. After all, a Trump victory and a “ Red Sweep” could send USD/JPY into the 160 stratosphere, and no one wants to stand in front of that freight train, including the Ministry of Finance, at least until the US election dust has settled.

Still, the MOF was out jawboning this morning, smoothing things over :

Japanese Finance Minister Shunichi Kato chimed in with a warning, saying, “We are seeing one-sided, rapid moves” in the FX market and hinting at potential intervention. His comments temporarily relieved the yen, but let’s be honest: If U.S. yields keep rising and Trump’s chances of a win increase, the yen’s reprieve will likely be short-lived.

As it stands, this has turned into a pure polling play. While I’ve adjusted my stance due to election risk, I’m still bullish on the yen once the dust settles on the US election. Post-election yen weakness could also push the Bank of Japan to tighten its monetary policy sooner rather than later. BoJ Governor Kazuo Ueda even hinted that a "very, very gradual" approach to tightening could be problematic, especially if markets expect low rates for too long. So there is a bit of double barrel pushback on JPY weakness today; the question is, assuming you cut USDJPY longs on the intervention jawboning, do you want to reload?

While we’re not getting clear signals on the timing of the next BoJ rate hike, market participants will be laser-focused on the BoJ’s upcoming policy meeting at the end of this month, eagerly awaiting any hints of another rate increase before the year’s out. I’m still betting on a December hike from the BoJ, which could serve as the perfect catalyst to crush USD/JPY lower from its currently lofty levels. But don’t forget the potential wildcard—the "Trump Jump" play. After all, Trump is on record saying, “We have a big currency problem,” in reference to a weak yen. If he retakes the reins, we could see some serious action in USD/JPY, making it one to watch closely.

So, buckle up. We’re in for a wild ride as the election looms, the yen wobbles, and global markets brace for whatever comes next. And now you know why I was famous for standing up on my desk in the trading room, belting out “Momma Don’t Let Your Babies Grow up to Be Forex Traders,” my tribute to the legendary Waylon Jennings & Willie Nelson hit. The original warned about cowboys, but in our world, I was warning about the relentless, never-ending hamster wheel of currency markets that keeps us spinning. Sure, there are easier career paths to take, but honestly? From the mid-’80s to 2020, there was no better place to be than in the Chief Trader's hot seat, riding the wave of market madness!

RIP Kris Kristofferson