MARKETS

The equity markets experienced a mixed performance last week, characterized by limited major market-moving data. Still, the S&P 500 index eventually rose by 1.4%, reaching a record high and surpassing the significant milestone of 5000 for the first time in history. Several factors contributed to this positive momentum, including robust economic data observed in recent weeks, persistent expectations of an impending easing cycle by central banks, and consistently strong earnings results. These supportive factors collectively underpinned market sentiment and bolstered investor confidence in the equity markets throughout the week.

As we delve further into the earnings season, the results thus far are promising and have contributed to maintaining market stability. With approximately 70% of the S&P 500 companies having reported their Q4 results, an impressive 80% have exceeded earnings expectations, according to Refinitiv data. During bullish market conditions, this performance surpasses the typical longer-term average of around two-thirds or even the mid-70% range.

Moreover, there has been a notable improvement in earnings growth projections. Earnings growth for the S&P 500 is now estimated at 9% year-over-year, a significant upward revision from the initial forecast of 4.7% year-over-year growth at the beginning of the year. This upward trend indicates that Corporate America is delivering strong financial results and consistently surpassing the expectations set by analysts and investors alike.

The anticipation surrounding Friday's annual CPI revisions from the BLS was palatable, with Fed officials like Jerome Powell and Chris Waller highlighting their importance for monetary policy decisions. There was concern that the revisions might indicate that recent disinflation progress was misleading, akin to revisions last year that questioned the effectiveness of aggressive rate hikes in 2022.

However, the revisions turned out to be anticlimactic, just the way Fed policymakers sought confirmation that inflation had moderated as anticipated, especially after signalling a dovish pivot towards the end of last year. Even though there is little to see in the revised data, markets embellished evidence to suggest inflation moderated to the degree that Fed officials were led by statisticians to believe.

Based on the revisions, the market's implied odds of a rate cut next month remained essentially unchanged( hence little to see here), hovering around 20 -25 %. However, several top-tier data releases between now and the March FOMC meeting make it difficult for traders to discount the possibility of a rate cut entirely.

With last year's revisions concluded, market attention will now pivot to the first CPI readings 2024, scheduled for next week.

Surpassing the 5,000 mark, the S&P index finds itself 800 points beyond the most pessimistic Wall Street forecast for the end of 2024, as anticipated at the beginning of the year. I won't name-drop as I think that is in bad taste, but as we said when this forecast came out, most of the 2024 forecasts will be wrong for no other reason than historicals no longer seem applicable in this market. In other words, you can not rely on old models.

Skepticism remains widespread in the market, yet stock prices continue to rise, with the global benchmark for risk assets nearing some of Wall Street's more optimistic year-end targets. Despite concerns about lingering inflation, the overall US macroeconomic landscape suggests a soft landing scenario.

The recent annual CPI revisions from the Bureau of Labor Statistics (BLS) affirmed the disinflation observed in 2023, indicating that the trend was genuine within the statistical framework. This development, albeit not widely discussed in the media, reassures Jerome Powell and his colleagues at the Federal Reserve. The revisions align with the deceleration trends observed throughout 2023, potentially easing concerns about inflationary pressures.

I'm unsure why rates didn't rally more, especially with whispers pointing to a reacceleration and getting quoted in a well-subscribed business publication. Indeed, name-dropping, especially well-known strategists with dumb ideas, is replete at this publication, which I assume is to pay the bills on slow news days.

OK, kids, listen up: There ain't no such thing as accurate whisper numbers regarding macro.

This oddity seems to come up repeatedly by the usual tin foil hat types. My argument is and always has been when it comes to macro whispers: why would anyone take the career or reputational risk of trading or even sharing whispers?

Finally investment decisions should not be solely based on skepticism towards central bank policies or fear of market bubbles. If you sit there and listen to El-Erian’s endless drivel about the Fed and impending policy mistakes or perma bears on Wall Street you will miss the boat.

Participating in market trends, including bubbles, can indeed lead to profits, at least in the short term. Many investors who remained cautious or bearish throughout the recovery from the Global Financial Crisis (GFC) or the COVID rebound missed out on significant rally party’s

FOREX MARKETS

On Friday the yen found some semblance of stability at weaker levels following a sharp sell-off, resulting in USD/JPY reaching a new year-to-date high of 149.49. The latest weakness in the yen has prompted comments from Japan's Finance Minister Suzuki, who emphasized the close monitoring of FX markets. Suzuki reiterated the importance of stable FX movements that reflect underlying fundamentals. These remarks suggest that recent yen weakness is raising concerns among domestic policymakers, who aim to temper yen selling as USD/JPY approaches last year's high.

The IMF's recommendation regarding Japan's monetary policy suggests a shift away from unconventional measures such as Yield Curve Control (YCC) and Quantitative and Qualitative Easing (QQE) toward a more conventional policy stance. Here's a breakdown of the key points:

Higher Wage Hikes: The IMF expects wage hikes in the current year to surpass those of the previous year. This could signal potential inflationary pressures and may prompt a reevaluation of monetary policy tools.

Exiting YCC and QQE: The IMF recommends that the Bank of Japan (BoJ) consider exiting YCC and ending QQE. These unconventional measures were implemented to stimulate economic activity and combat deflation.

Gradual Policy Shift: The IMF suggests that any policy changes should be gradual and well-communicated to anchor market expectations. Abrupt changes could lead to market volatility and uncertainty.

Communication from the BoJ: The IMF notes that recent communication from the BoJ indicates a possible move toward removing negative interest rates, possibly in March or April. This suggests that the BoJ is considering adjustments to its monetary policy framework in line with the IMF's recommendations.

Overall, the IMF's recommendations reflect a cautious approach to monetary policy normalization in Japan. The BoJ will need to carefully assess economic conditions and market dynamics before implementing any changes to its policy framework to ensure stability and sustainable growth in the Japanese economy.

OIL MARKETS

Oil futures experienced a relatively flat trading session for most of Friday. However, typical to market behavior, they saw a bid in the afternoon US session due to concerns arising from weekend headlines.

The latest leg of the rally was triggered by the US Treasury's announcement of renewed enforcement measures on Russian oil sales.

Geopolitical incidents also provided support to crude prices despite the building inventory in the United States and low refinery utilization. According to the Energy Information Administration's report on Wednesday, commercial crude inventory increased for a second consecutive week through Feb. 2, rising by 6.754 million barrels since Jan. 19. However, this increase was largely due to a decline in refinery runs which reportedly plumbed to 82.4% of capacity, marking a 13-month low.

CHARTS OF THE WEEK

I don't think SocGen's most celebrated employee has ever seen a market he liked, but he might have a point here. 5000 just sounds like one of those symbolic milestone numbers that might take a few runs at to crack

Wow! And you can add to that extreme bullish sentiment on the AAII survey. Maybe the market having got to 5,000, now flops prostrate on its back for a while to from technical exhaustion.

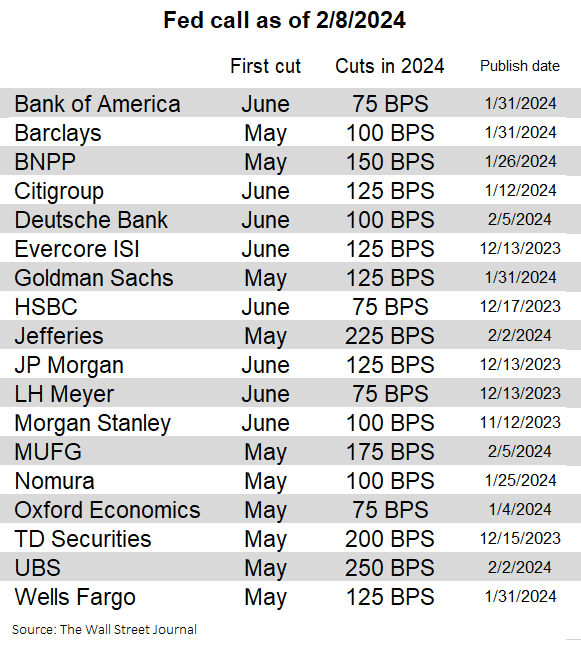

Draw a number out of a hat #Fomc. The "extra" cut premium above and beyond 75 basis points the Fed has signalled reflects two main hedge factors: i) Traders' assessment of the Federal Reserve's willingness to act decisively in response to devolving economic conditions.( I think this is 50 pb worth of premium in 2024) ii) The perceived probabilities traders assign to various tail risks, including geopolitical events, economic shocks, and other unforeseen developments that could impact the economic outlook and necessitate policy adjustments by the Fed. ( I see this as 15 bp of premium) So between 125 & 150 sounds about right IMO

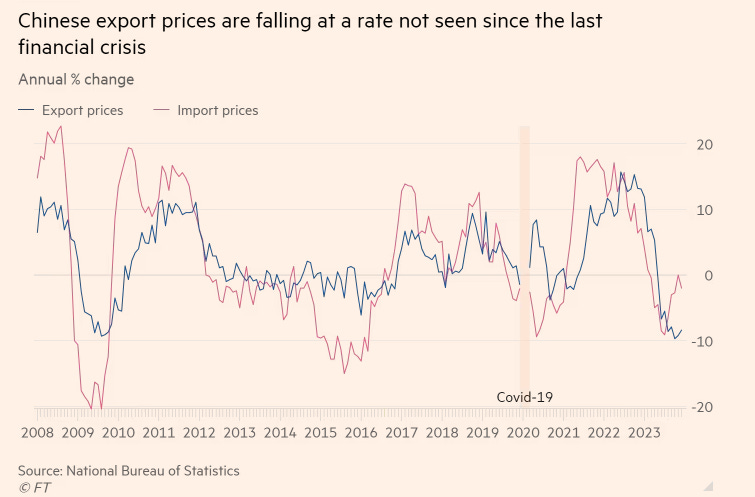

The way China exports deflation is by exporting more goods and thus producers who don't match the lower China price lose market share. the RMB and weak domestic demand say "but China" -- creating a powerful force opposing "near shoring," "decoupling" and the like

SONG OF THE WEEK